Money laundering has always been a heavy criminal act and still it happens more often than you might think.

Casinos whether we talk about soil-based or online have always been the target of criminals who want to launder their illegally earned money.

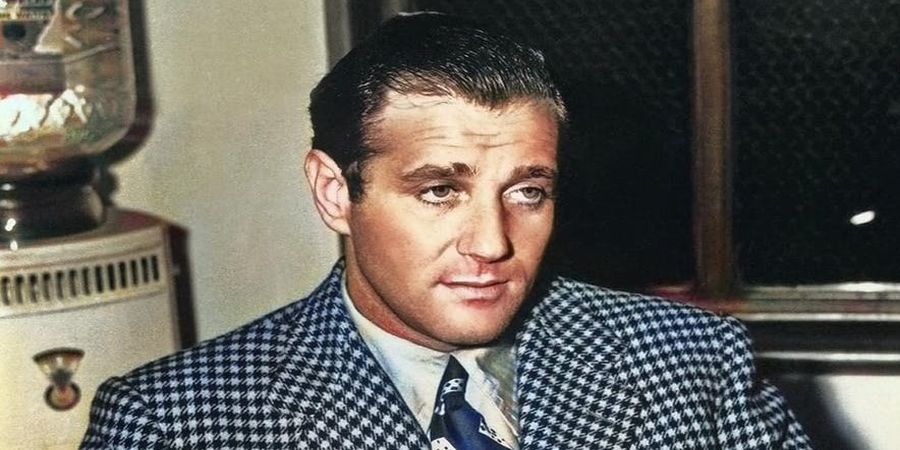

If you look at old mafia Las Vegas casino movies like casino 1995, you will notice that many notorious criminals owned or have been connected with casinos.

Let’s take for example the notorious Bugsy Siegel who set up gambling dens and gambling yachts while running the already existing prostitution, narcotics and money laundering operations through his gambling venues in Las Vegas.

The money-laundering action in the casino is reflected in the action to buy chips in cash and receive remittances at the bank during the payment.

Many casinos also pay out money in checks that you can deposit in the bank and use for spending.

Once you pay out the money at the casino it will be considered as if you have won. Today it is a little different, and there are many new laws that have made money laundering more difficult for individuals.

But this method has not always been eradicated. Let’s learn a little more below.

What is money laundering?

In short: Money laundering is a deed of making illegally gained sum to look like it was earned trough legal actions.

Lawbreakers ‘clean’ their illegal earned money through particular types of transactions, assets, and other activities that hide the initial source of the budget.

The final goal is that “illegal” money becomes legal and available for use without any suspicions.

The term “money laundering” came from the famous mafioso, Al Capone. He used to make his illegal earnings legal through his laundromats stores across the NY state.

Today this term become a synonym for many different techniques of tricking the tax organizations about the origin of money. According to a UN survey, the estimated amount of money laundered worldwide is about $2 trillion on a yearly basis.

We must mention that this number is only approximate, not real because due to the secrecy of these actions, it is impossible to find the exact amount of money that is “laundered” globally every year.

How money laundering works?

Although money laundering has been present in society for centuries and over time, it has become very complicated, it ends in only three basic steps.

This means that every criminal who plans to launder his money will have to follow steps including: placement, layering and integration.

Knowledge of these actions has made it much easier for the authorities and organizations that fight against money laundering, but unfortunately, it has not completely prevented it. Let’s look at the three basic steps to launder money

1. Placement

After criminals obtain dirty money, the first step is to place it into the financial system. This implicates depositing the sums into a business bank or middleman bank accounts.

The step of placement is the riskiest one where criminals get caught mostly.

This happens due to depositing large sums into a particular account from nowhere. Basically, it looks very suspiciously if it is not done cautiously.

2. Layering

The next step is layering, which means that funds need to be camouflaged making complicated layers of monetary transactions in order to make money origin not traceable.

This is the step where launderers conceal the trail of the money and create a tracing of it much difficult as possible.

There are many techniques to make this work including some of the most known like changing currency, spreading to various bank accounts in different countries and names, or buying assets and real estate.

3. Integration

In the end, the criminals who laundered money now have clean money back through integrations into the legal financial systems.

The clean money can now be merged through a bank transfer to a freshly created new company or in the form of a salary.

After the funds are laundered, it becomes very hard for the government and anti-laundering organizations to trace it due to obtained criminal activity.

Money laundering through gambling

Gambling and casinos as we have said at the beginning of this article were always one of the most common solutions for money laundering.

So even with new laws, requirements and measures by law enforcement bodies gambling will always be used as an untraceable platform for converting dirty money into clean.

Money laundering through land based casinos

Some of the most common techniques to launder money through casinos include:

- Buying chips in the casino, play certain time and head to the cashier to payout. Casino in most cases payout winnings in the form of a check that can be converted into money through banks and post offices.

- Deposit into fixed odds betting terminal machines (FOBT) play a few rounds, lose a small amount and hit the cash out. By cashing out players receive a receipt that can be proof of winning at the casino.

Money laundering through online casinos and sportsbook

When it comes to online casinos, lately is noticed a large increase in money laundering thanks to huge amounts of money that flows through online gambling sites such as online casinos and sportsbooks daily.

Also, there are many methods to clean filthy profit through gambling sites, but the most common one includes:

- Deposit a big large of cash into a casino account and spend a few small bets just for formality sake, before heading to the cashier page for payout.

This method is even harder to catch if the launderers are more careful and break their sums into smaller deposit amounts.

This goes so deep that criminals create hundreds of casino accounts with low deposits that can not bring any suspicion or attention. After a short period, they pay out all their deposits. In these cases, any suspicious can not hold, because it all looks legitimate.

Anti-money laundering enforcement and regulations

Many unlicensed online gambling sites are kept their eyes closed when it comes to money laundering.

Most of these unlicensed sites are in conjunction with criminals or budgeted by criminals.

These sites do not have any anti-laundering policy nor are licensed by any of the gambling regulatory bodies.

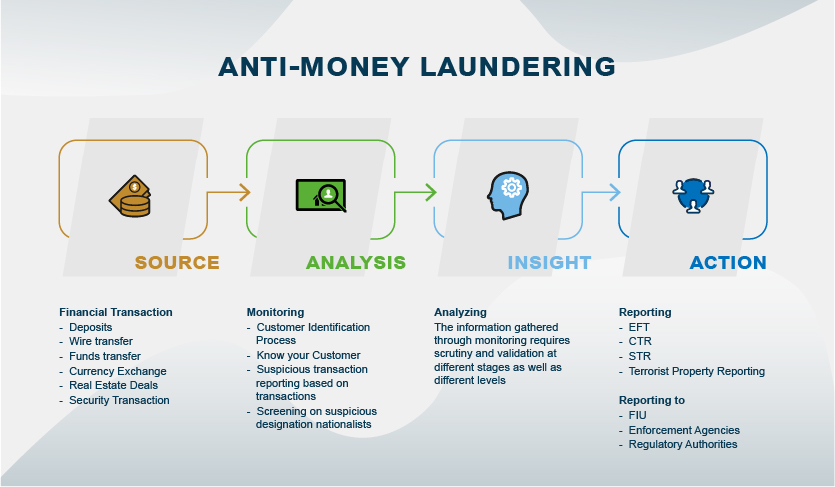

What’s even worse, according to an FBI report from 2021 at many licensed and regulated websites, there are available possibilities to transfer large amounts of money in and out of various gambling accounts. This is why operators come up with precautions like:

- Customer identification processes

- KYC protocols

- Transaction reports

- Screening and gathering info

But, anti-money organizations are determined to fight more than ever against money laundering within online gambling, with many trained personal working on gambling operators.

No matter what measures and regulations are imposed by the government and organizations in a fight against money laundering, the expected worth of the online gambling market in 2023 is set to be more than 92.9 billion dollars, globally.

These figures will result in a challenge for anti-money laundering agencies to fight even harder. But also in seducing criminals to use it even more.

However, all regulated gambling operators will have a task and a moral duty to guard customers and keep money laundering out of the online gambling market.

Money laundering through cryptocurrency

The advent of cryptocurrencies and digital banking transactions has enabled criminals to move money very quickly and covertly, which has made actions such as laundering even easier.

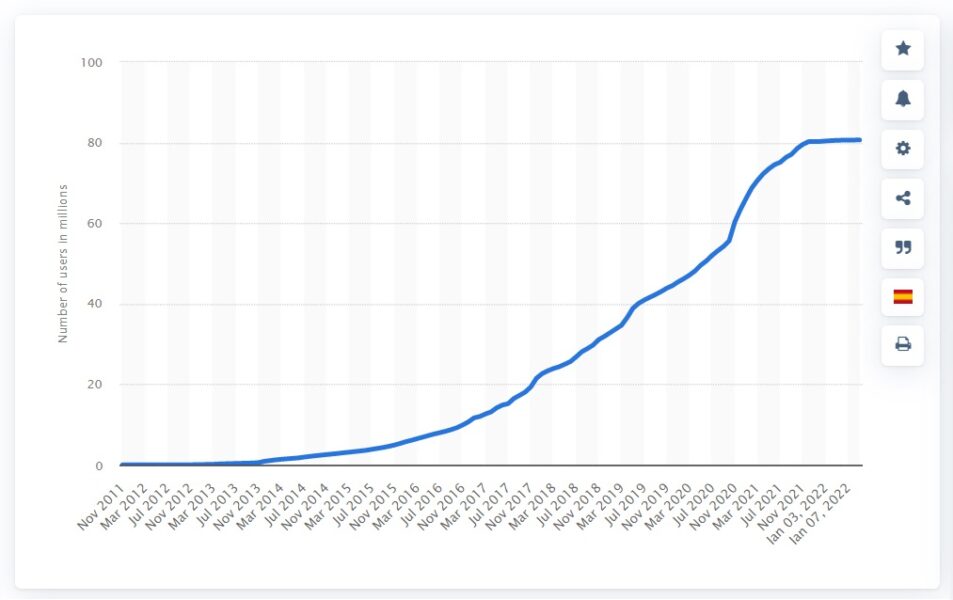

In June 2021 reportedly the number of crypto (bitcoin) users reach over 221 million. The biggest advantage for criminals and the biggest disadvantage for law enforcement agencies is the anonymity when using crypto.

This makes it criminals even easier launder money and harder for the law to trace it.

But what will happen and how the governments will try to stop crypto laundering will be interesting to witness until then crypto is continuing to grow in usage and popularity terms.

FAQ

Are casinos used for money laundering?

Unfortunately, yes. Gambling has always attracted money launderers whether we are talking about physical or virtual casinos. There are many methods for money laundering, but gambling is one of the most common and widespread.

How does money laundering work at casinos?

The simplest way to explain is that casino money laundering works so that a person who wants to launder money enters the casino and buys chips with illegally acquired money, spends some time in the casino while spending a certain amount, and soon withdraws the money back and leaves the casino with funds which now look like gambling profits.

Do you need to report your casino winnings to tax agency (DIA)?

This depends on the country you live in, but in New Zealand the tax on gambling profits is regulated by the Lottery Tax ACT (552/1922) and the NZ Income Tax Act (1535/1992), while the gambling law is administered by the Department of Internal Affairs (DIA).

But you as an individual from New Zealand after winning a casino no matter the amount, are not required to pay taxes or report your winnings. Also if you choose to play at bitcoin casino NZ sites, you are not required to report any winnings.